The Colorado residential purchase and sale agreement establishes the terms and conditions of a real property transaction between a buyer and a seller. In most cases, a real estate broker (or two brokers, one for each party) will be involved in the transaction.

A purchase and sale document protects the buyer from losing money should they choose to terminate the agreement, and requires the seller to provide certain disclosures to the buyer to prevent a fraudulent or unjust sale. This agreement will include the purchase price of the property, earnest money amount, the closing date and costs, contingencies, considerations, and the signatures of all parties involved.

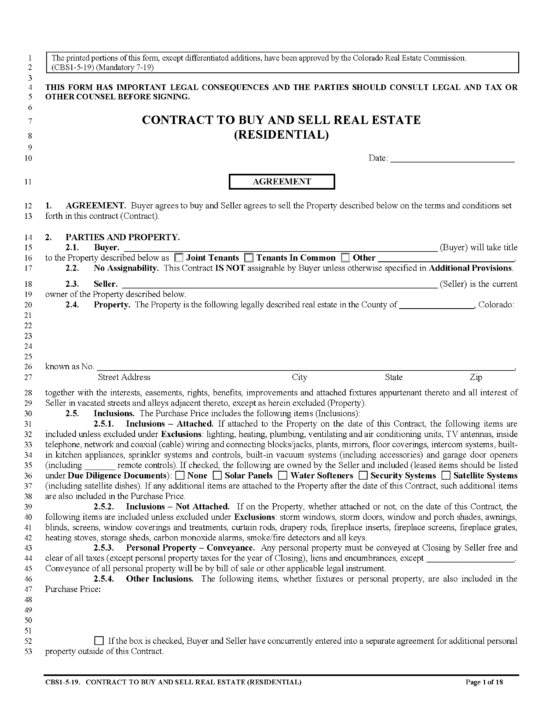

Contract to Buy and Sell Real Estate – A residential real estate purchase agreement created by the Colorado Real Estate Commission. This is the most widely-used purchase and sale contract in the state.

1) Common Interest Community

All purchase agreements for real estate located within a common interest community must include a specific disclosure statement which is detailed in the statutes linked below.

2) Green Disclosure Form

Colorado has implemented a disclosure form aimed at making properties more environmentally friendly and disclosing any energy-saving issues that apply to residential property. The seller must complete this form and provide it to any prospective buyer.

All sellers of residential real estate built before 1978 must provide this lead paint disclosure form to potential buyers in accordance with federal law.

4) Methamphetamine Production

If the seller is aware that the property they are selling was once used as a methamphetamine laboratory, they must disclosure this fact in writing to the potential buyer. However, this does not apply if the seller is aware if the property was used in such a capacity but has been remediated in compliance with § 25-18.5-102. (Furthermore, the buyer has the right to hire a certified industrial hygienist to conduct testing on the property to determine if meth was ever produced on the premises. If the test results are positive, they may terminate the purchase agreement.)

5) Oil and Gas Activity

Either the purchase agreement or the seller’s disclosure statement must contain an oil and gas activity disclosure statement, which must be worded in substantially the same manner as the statutory disclosure linked below.

6) Potable Water

The statutes linked below contain a specific potable water disclosure that must be included in the purchase agreement, listing agreement, and seller’s property disclosure statement when transferring residential real property. Furthermore, if the source of potable water is a well, the seller must provide a copy of the well permit (if available).

There is no specific statute that requires sellers to complete this Colorado Real Estate Commission Property Disclosure Statement. However, certain disclosures are required by law (see linked statutes); therefore, this document can be completed by the seller to ensure that they do meet all the state-specific disclosure requirements, in addition to giving the buyer an overview of the property’s condition.

8) Taxing Districts

A purchase agreement for a real estate transaction in the state of Colorado must have a special taxing district disclosure statement contained therein (full statement outlined in the statutes below).

9) Transportation Projects

The seller must disclose to the buyer the existence of any proposed or existing transportation projects that may affect the property being sold. (This disclosure will usually be included in the property disclosure statement document.)