A Business Credit Application Form is essential for businesses seeking credit from financial institutions or suppliers. This complete guide covers everything you need to know about filling out and submitting a Business Form effectively. From understanding the key components of a Credit Application Form to ensuring accuracy in your submissions, our guide provides detailed examples and practical tips. Whether you’re a startup or an established business, this guide will help you navigate the credit application process with ease. Learn how to maximize your chances of approval and secure the financing you need to grow your business.

A Business Credit Application Form is a document used by businesses to apply for credit from lenders or suppliers. This Credit Application Form collects essential information about the business’s financial status, credit history, and repayment ability. It helps lenders assess the risk and determine the creditworthiness of the applicant. Completing this form accurately and thoroughly increases the chances of securing business credit.

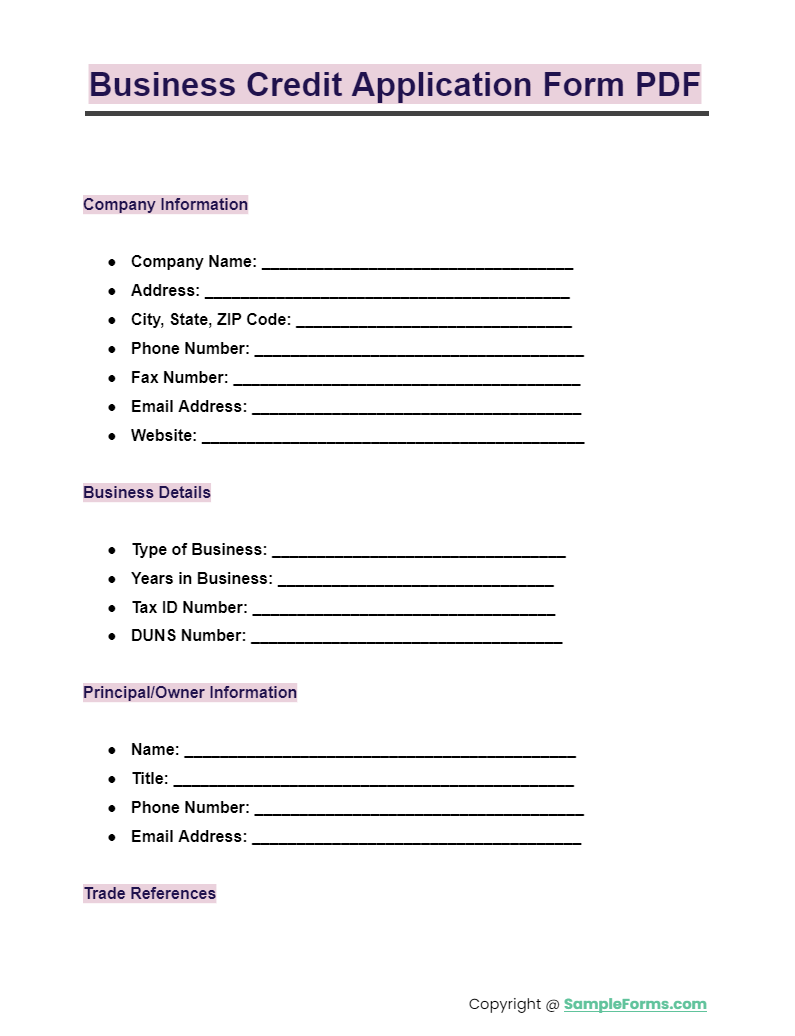

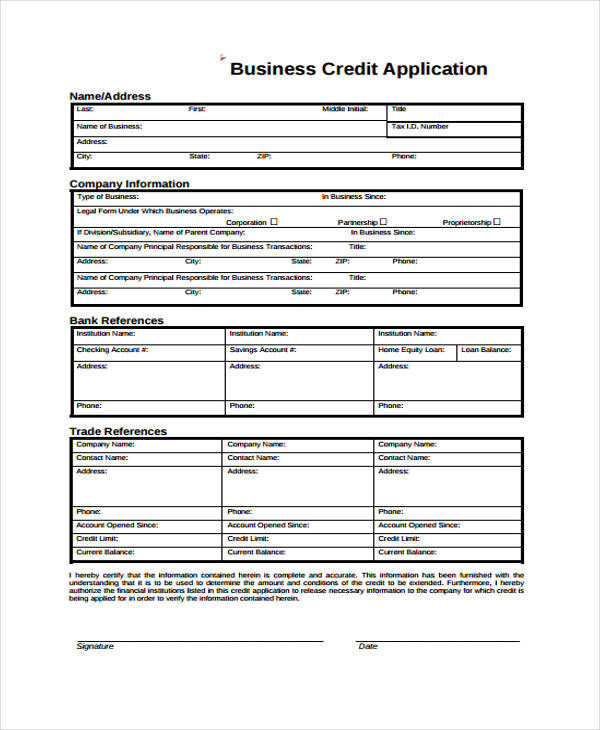

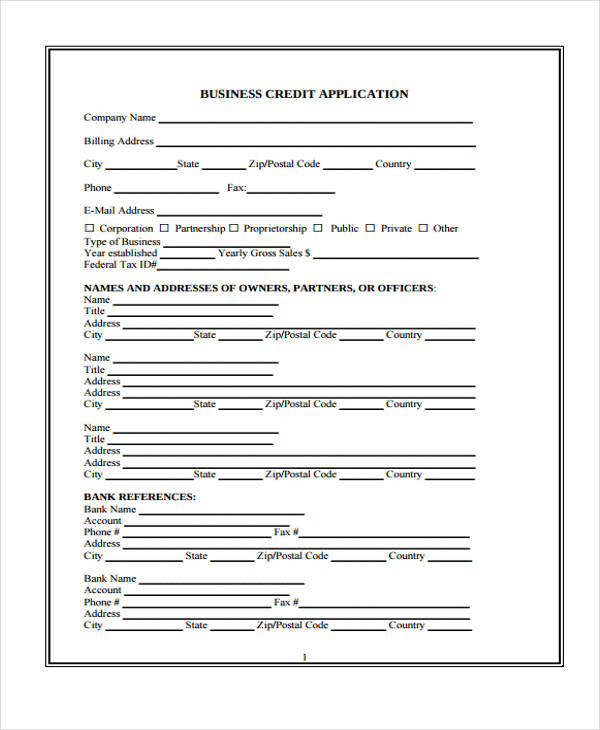

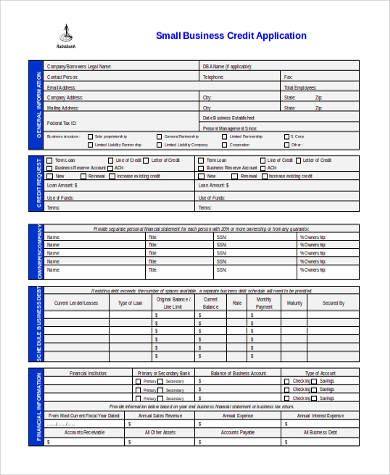

A Business Credit Application Form PDF provides a standardized format for businesses to apply for credit. It ensures that all necessary financial information is included, similar to how a Job Application Form ensures comprehensive employee details.

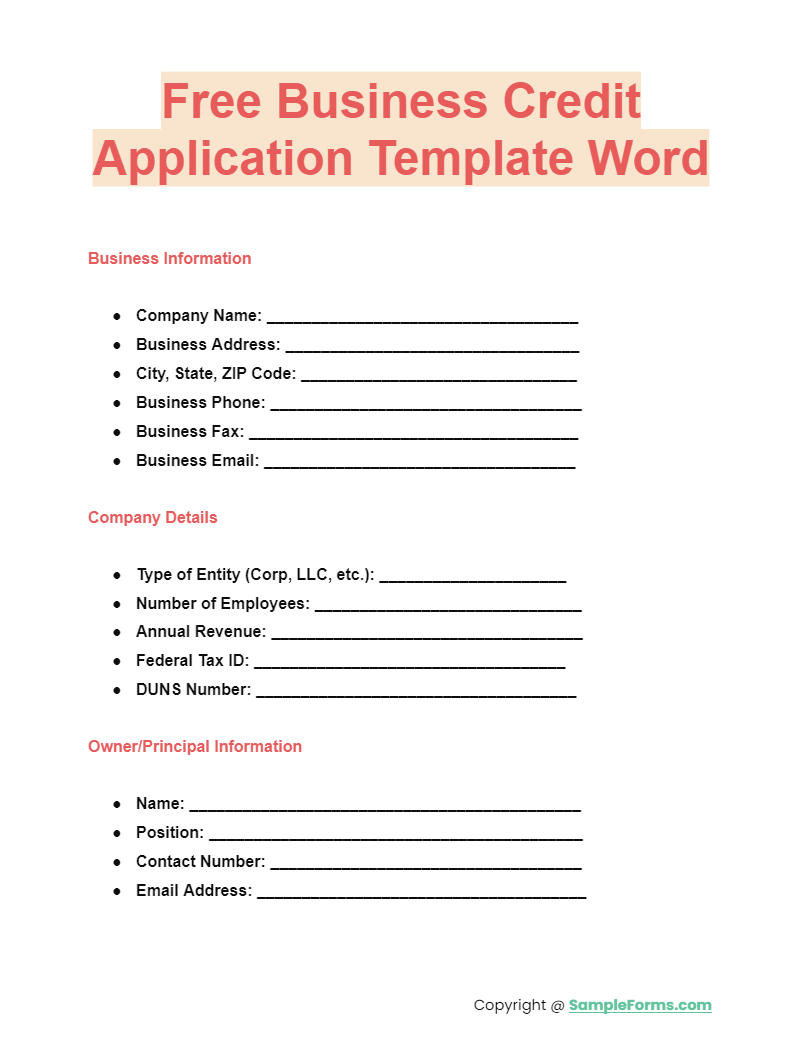

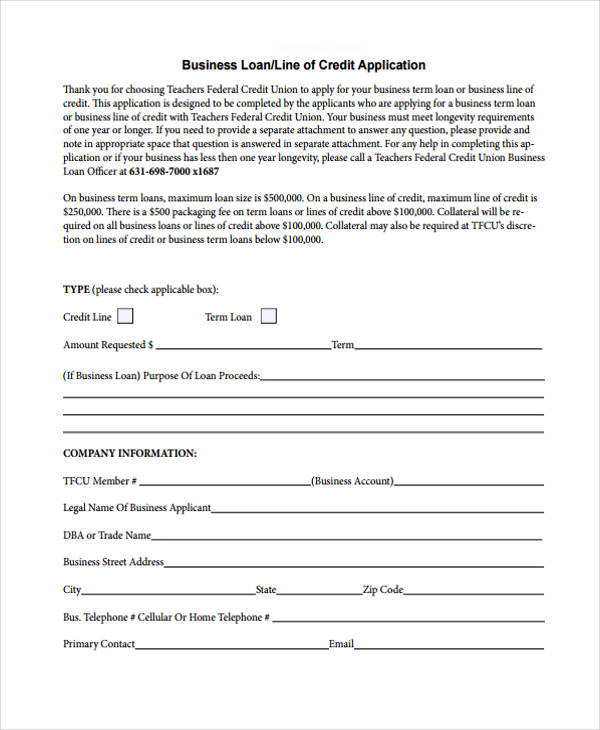

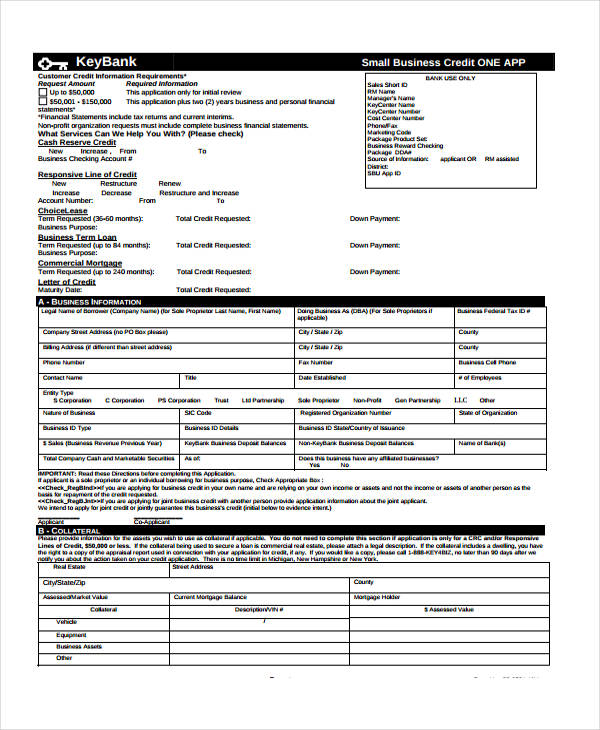

A Free Business Credit Application Template Word offers a customizable document for businesses seeking credit. This template simplifies the process, much like a Loan Application Form does for individuals, ensuring all necessary details are covered.

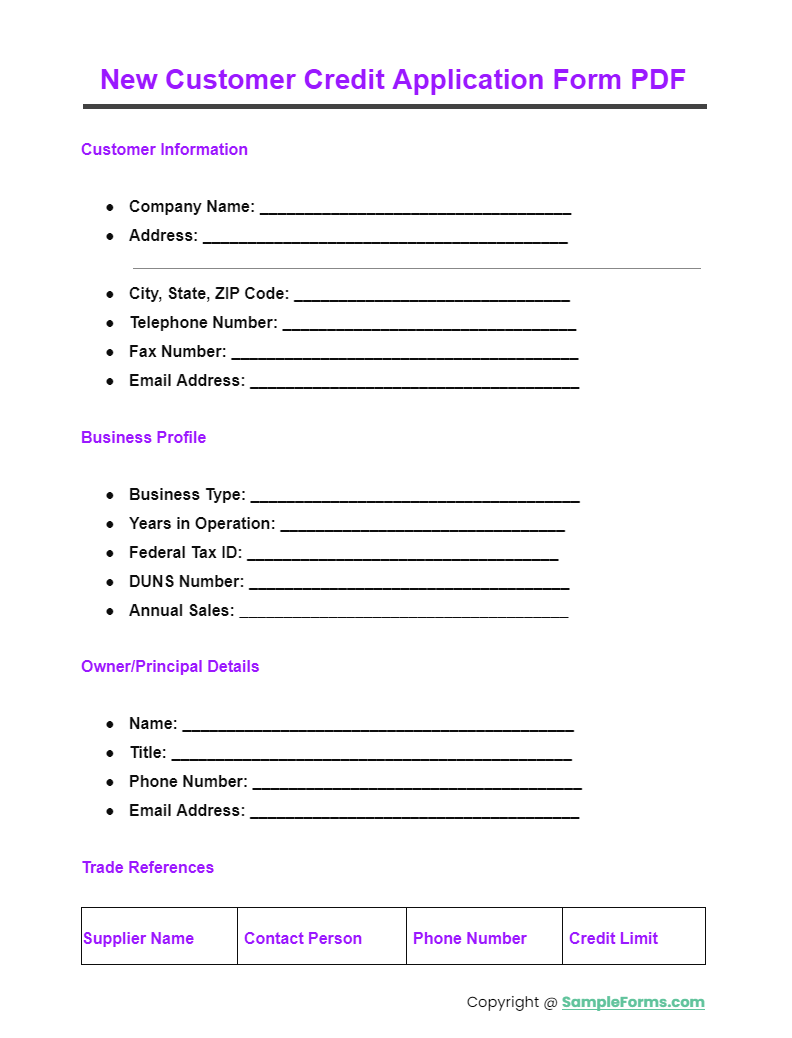

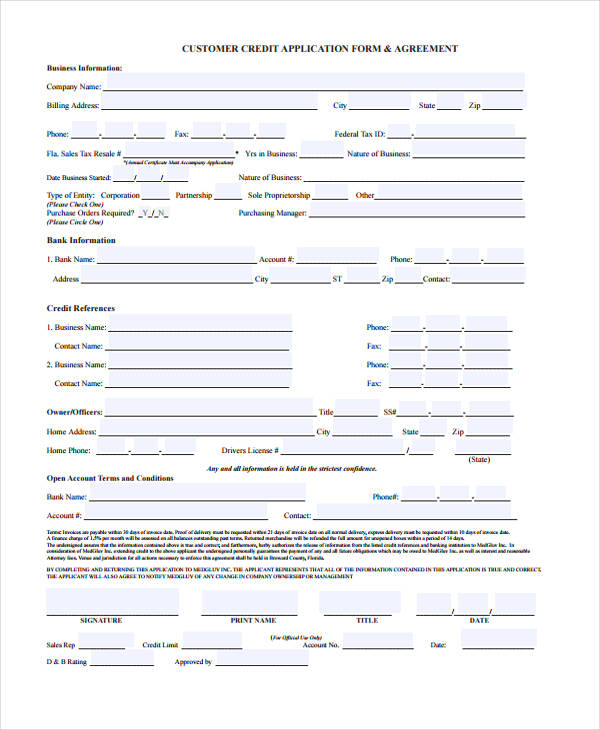

A New Customer Credit Application Form PDF is essential for onboarding clients needing credit. This form ensures all relevant financial and business details are collected, akin to a Marriage Application Form gathering essential personal information.

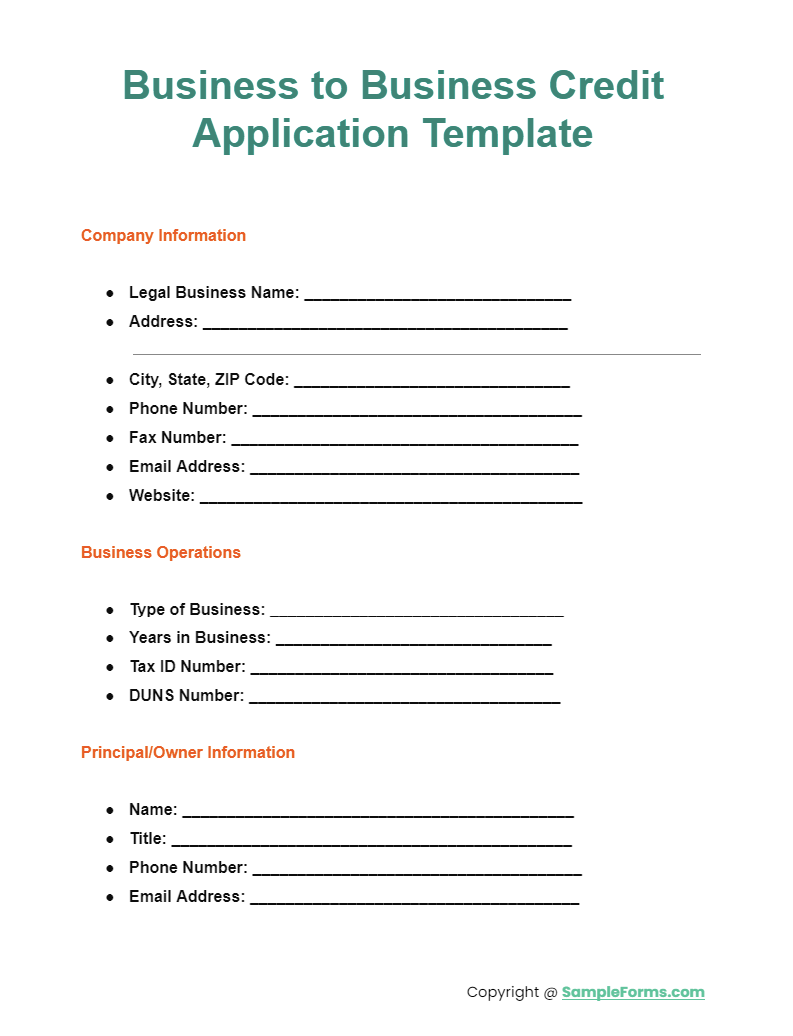

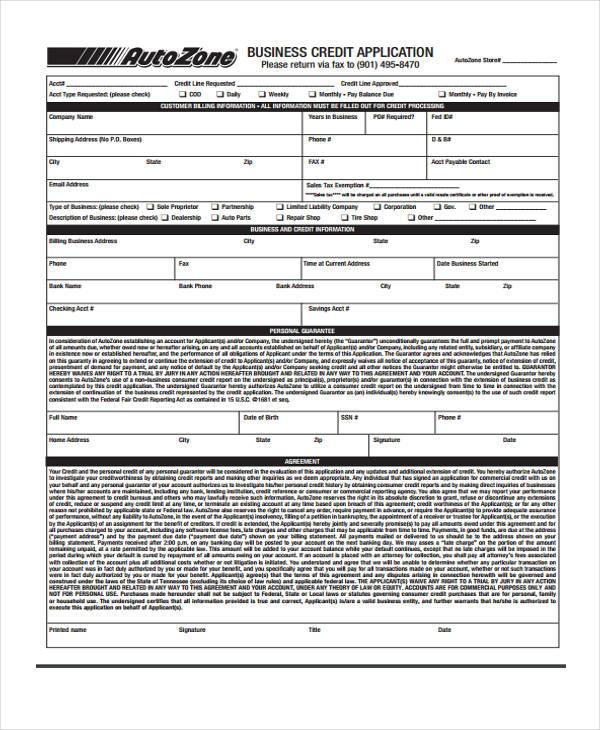

A Business to Business Credit Application Template streamlines the credit application process between companies. This template, similar to a School Application Form, ensures that all required information is systematically captured for review.

connected1.net

File Format

teachersfcu.org

File Format

medgluv.com

File Format

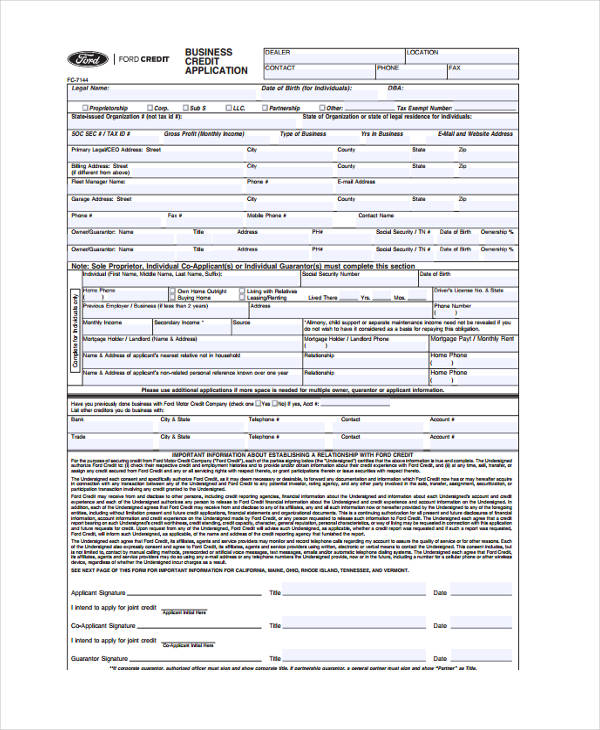

ford.com

File Format

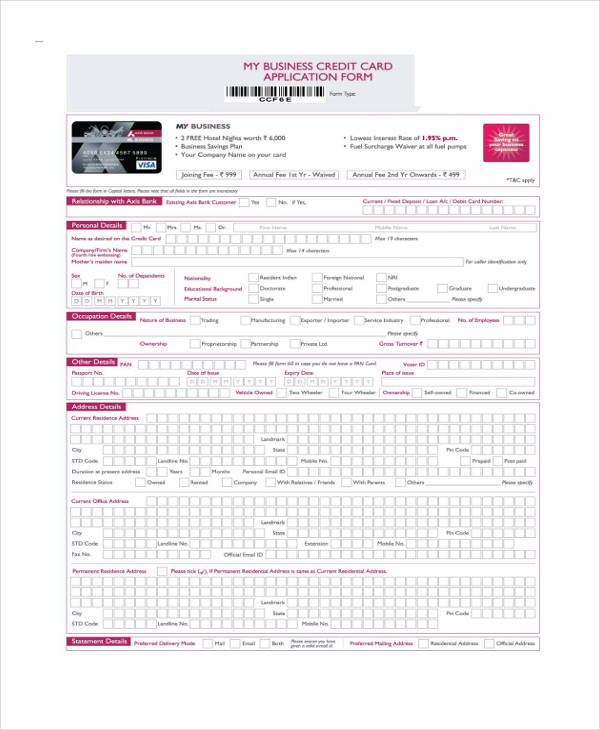

axisbank.com

File Format

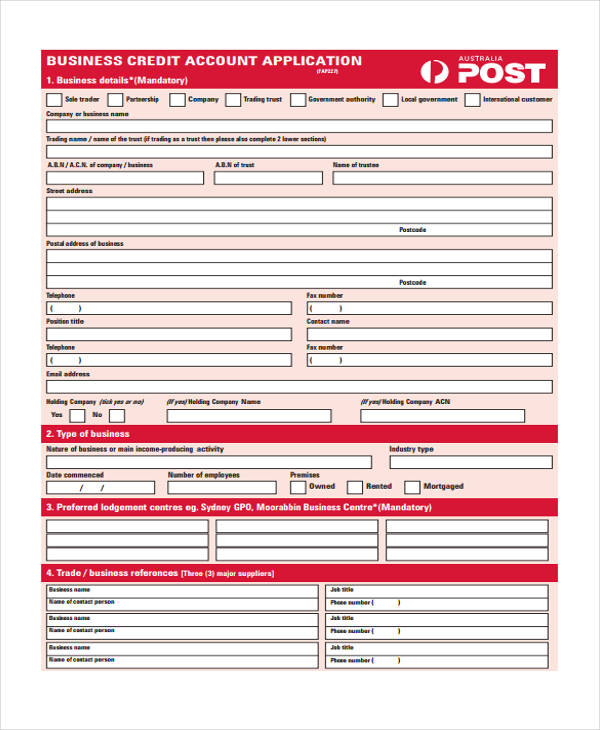

auspost.com.au

File Format

devcocorp.com

File Format

autozonepro.com

File Format

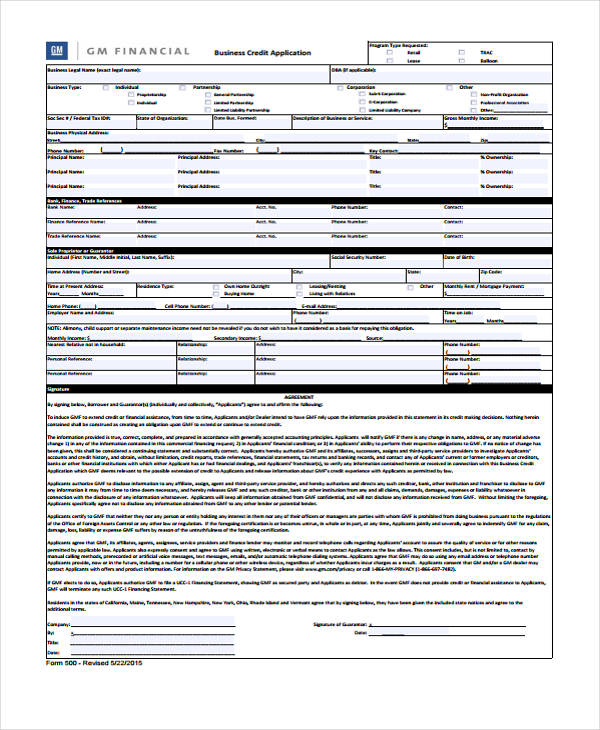

dealers.gmfinancial.com

File Format

dicksrestaurantsupply.com

File Format

rabobankamerica.com

File FormatBusiness credit is a risky and huge step to involve in your business. One must know an individual’s credit history, employment status and their capability to repay the amount of credit. Once you are permitted to contact reliable references, then please do so. Businesses cannot take chances when it comes to approving Business Credit Applications. You may also see Business Credit Application Form

With forms widely used by people and organizations these days, we are pleased to inform you that our website provides you with Business Credit Application form samples and many other legal forms and documents. These downloadable and Printable Application Forms are specifically catered for your needs and we guarantee you that these forms are very simple and easy to use. With only one click from your laptops and desktop computers, you can easily have access to these forms. You may also see Application Form

Similar to Business Application Forms, when applying for Business Credit Application Forms, basic information such as your personal and contact information are requested. A Business Credit Application is usually a statement of request for an extension of credit in an organization.

When applying for a Business Credit Application, the following details should be included:

When a credit application is validated, it will provide the amount and type of credit requested. But keep note of one thing. You need to verify a creditor’s existence. One can simply indicate fraudulent and misleading information in a Business Credit Application form. You may also see Membership Application Form

To avoid any misconceptions and misfortune for your company, it is best for the management to verify a customer’s legitimate identity. An individual’s credit scores are one of the major factors that an organization should evaluate in the business credit application. You may also see Internship Application Form

Another major factor to consider is an individual’s credit history. If an individual has regularly paid their bills, then they are most likely a legitimate creditor. But if you find out that an individual does not have the ability to pay or repay the credit on a regular basis, then you may make the decision to reconsider their application, as approving their application may prove to be disastrous for your business in the future. You may also see Business Application Form

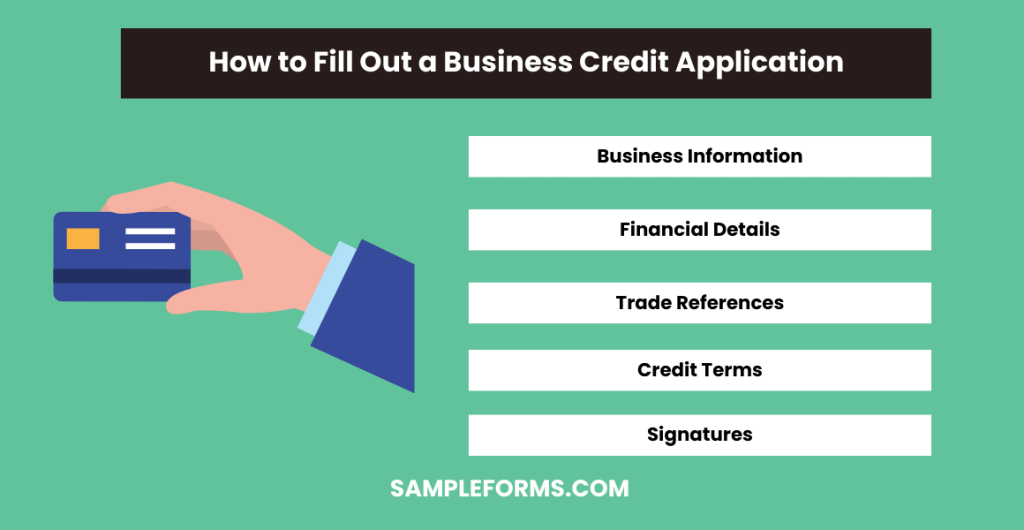

A credit application form is typically filled out by the business owner or an authorized representative. Key steps include:

Filling out a business credit application involves providing comprehensive business and financial details. Follow these steps:

Declining a credit application requires tact and professionalism. Key steps include:

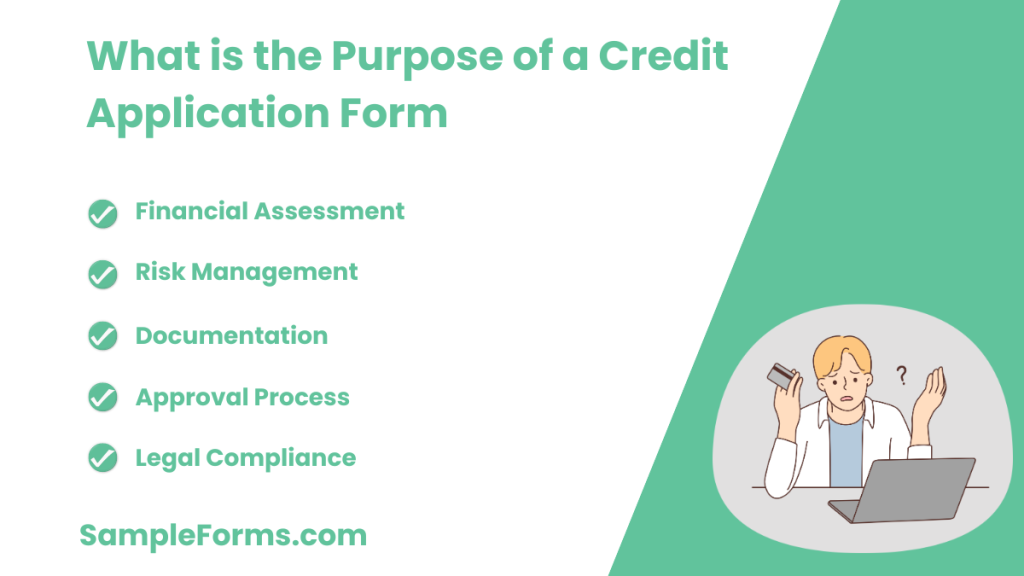

A credit application form assesses a business’s creditworthiness. Key purposes include:

Mistakes on a credit application can delay processing or lead to denial. Key steps to rectify include:

Yes, it is safe to fill out a credit application online if the website is secure and reputable, similar to filling out a Mortgage Application Form.

Politely request customers to complete your credit application by highlighting its benefits and ensuring the form is straightforward, akin to a Rental Application Form.

Credit applications are signed by the business owner or an authorized representative, much like a Car Loan Application Form requires the applicant’s signature.

Yes, credit applications often check income to assess the applicant’s ability to repay, similar to the process in a Medical Application Form.

Typically, the applicant requesting the letter of credit pays for it, similar to fees associated with a Housing Application Form.

If your credit application is rejected, review the reasons, address issues, and consider reapplying or exploring alternative financing options, like when a Citizen Application Form is denied.

Banks evaluate financial statements, credit history, business plan, and income, similar to the criteria used in a Summer Camp Application Form to assess suitability.

In conclusion, a Business Credit Application Form is crucial for businesses seeking credit to support their operations and growth. Our guide provides detailed samples, forms, and letters to assist you. Utilizing a comprehensive Business Credit Checklist Form ensures all necessary information is included and increases the likelihood of approval. Understanding and correctly completing this form is vital for securing the financing your business needs to thrive. By following the strategies and examples in this guide, you can streamline your credit application process and achieve better financial outcomes.